What is GST stand for? What is the rate of it on all construction and building products like the stone with different types of it?

building stone Ireland

The Goods and Services Tax (GST) is a single tax that is applied to the supply of goods and services, beginning with the manufacturer and ending with the customer. As a result of the fact that credits for input taxes paid at each level will be available at the succeeding stage of value addition, the Goods and Services Tax (GST) is basically a tax only on value addition at each stage. The GST Rate Applying to Construction and Building Materials In this post, we will explain the Goods and Services Tax (GST) rate that applies to cement, bricks, tiles, iron, steel, and other materials used in the construction industry. Building Materials and the HSN Codes That Are Associated With Them The HSN Code organizes many construction materials, including sand, cement, bricks, marble, granites, tiles, iron and steel, and other building supplies, into a number of separate chapters. Examples of these materials include: As a consequence of this, it is absolutely necessary for construction experts to correctly classify items by utilizing HSN Codes. The Currently Effective GST Rate at Sand Unless the sand also contains metals, it will be included under Chapter 26 of the HSN Code, which applies to all naturally occurring sands regardless of color. The general goods and services tax rate for sand is 5%. As an additional point to mention, the Goods and Services Tax (GST) rate that must be applied to natural bitumen and asphalt, bituminous or oil shale and tar sands, asphaltites, and asphaltic rocks is 18%.

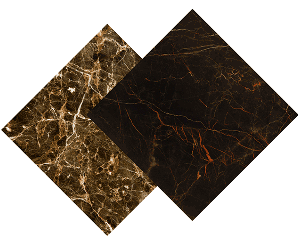

The percentage of Goods and Services Tax that is applied on Gravel, Crushed Stone, Marble, and Granite The following is a list of the various construction stones’ respective GST rates: Stone dust and gravel A 5% GST fee will apply to the purchase of any pebbles, gravel, or crushed stone that will be used in the production of concrete. Gravel and crushed stone fall under the following categories of HSN Codes, each of which is subject to a GST rate of 5%: tarred macadam; granules cheeping and powder of stones; pebbles, gravel, broken or crushed stone, of the sort typically used for concrete aggregates, for road metalling, or for railway or other ballast; shingle; and flint; whether or not heat-treated. When it comes to the manufacturing of lime and cement, flux limestone, also known as limestone and other calcareous stone, is an essential component. Marble and granite cut into block form The slabs of marble and granite have a 12% GST rate applied to them. Nevertheless, the Goods and Services Tax (GST) rate that applies to slabs of marble, granite, and travertine is 28%. The Primary Element On blocks and slabs of different stones used in building, such as porphyry, basalt, sandstone, and other monumental or building stone, the Goods and Services Tax (GST) is imposed at a rate of 5%. Please be aware that the GST taxation of stone products comes under a different HSN chapter and, as a result, attracts a different tax rate. This is because the GST taxation of stone items falls under a different HSN chapter. Cement’s Current GST Rate Despite differences in color or clinker form, it is anticipated that a GST rate of 28% will be applied to all varieties of hydraulic cement.

building stone institute

including Portland cement, aluminous cement, slag cement, super sulfate cement, and similar varieties. Chapter 25 of the HSN Code is devoted to the classification of cement. Steel and Iron Prices, Inclusive of GST Due to the fact that they are classified under HSN code chapter 72, the items made of steel and iron are all subject to the same GST rate of 18%. Therefore, an 18% Goods and Services Tax (GST) must be paid on iron building supplies such as blocks, wire, rolls, rods, and the like. The Typical Price of the GST for Bricks Bricks that are used in buildings are taxed at a number of different GST rates and are given several HSN codes, as will be outlined below. Bricks that are manufactured using fossil ash or other types of siliceous rocks are subject to a 5% Goods and Services Tax. Both sand lime bricks and fly ash bricks are subject to a GST rate of 12%. Bricks, tiles, and other similar products are all instances of cement, concrete, or artificial stone. Other examples include flagstones. The fundamental components needed for building, Any structural components that are prefabricated for use in construction or civil engineering are subject to a GST duty of 28%, regardless of whether they are constructed of cement bricks or not. The Goods and Services Tax (GST) is charged at the rate of 18% on bricks, blocks, tiles, and other construction materials manufactured of refractory ceramics that are not composed of siliceous fossil meal or analogous siliceous rock. Leaded lights and other similar items; pressed or molded glass paving blocks, slabs, bricks, squares, tiles, and other products used for building or construction; glass cubes and other glass small goods. whether or not on a backing, for mosaics and similar ornamental applications; The value-added tax (GST) rate of 28% applies to multicellular or foam glass products like as blocks, panels, plates, and shells. The GST Rate on Tiles Similar to how different kinds of bricks are subject to varying GST rates, distinct kinds of roofing tiles are also given their own individual HSN codes.

building stone steps into a hill

When it comes to the roof or earthen tiles, the Goods and Services Tax (GST) is set at 5%. Plastic floor coverings, plastic wall coverings (including tiles and self-adhesive panels), and plastic ceiling coverings are all subject to GST at the rate of 28%. The bamboo floor tiles are subject to an 18% Goods and Services Tax. The rate of goods and services tax (GST) that applies to panels, boards, tiles, blocks, and similar commodities that are agglomerated with cement, plaster, or other mineral binders and made from vegetable. fiber, straw, or of shavings, chips, particles, sawdust, or other waste, wood, is 28%. This rate applies to goods that are made from these materials. The Commodities and Services Tax (GST) is charged at the rate of 28% on any boards, sheets, panels, tiles, or other similar goods that are not ornamented and are made of plaster or compositions based on plaster. It is essential to be aware that the value-added tax (GST) rate of 28% applies to tiles made of cement, concrete, and synthetic stone. The rate of Commodities and Services Tax (GST) that applies to ceramic flooring blocks, support or filler tiles, and other goods of a similar kind is 28%. Regardless of their backing, ceramic items, heart tiles, wall tiles, mosaic cubes, and other similar products are subject to a GST rate of 28%. Glazed ceramic flags and pavement, hearth or wall tiles; glazed ceramic mosaic cubes, and the like are subject to a GST charge of 28% regardless of whether or not they are backed. This tax also applies to glazed ceramic mosaic cubes. The GST Rate for Construction Interiors

The Goods and Services Tax (GST) is charged at the following rates on any and all things that are required to finish the interior of a building. Copper Cable In accordance with the provisions of Chapter 85 of the HSN Code, insulated wire and cable are liable to GST at the rate of 28%. Recorders and reproducers of sound, recorders, and reproducers of images and sounds from television, as well as the components and accessories of such goods, fall under the purview of Chapter 85. Likewise, electrical machinery and equipment and the parts thereof also fall under the purview of Chapter 85. Utilization of Different Paints and Varnishes Paints and varnishes (including enamels and lacquers) that are manufactured from synthetic polymers or naturally occurring polymers that have been chemically changed are subject to a Goods and Services Tax (GST) rate of 28%. In addition, glaziers’ putty, grafting putty, resin cement, caulking compounds, and other mastics, as well as painters’ fills, and any no refractory surfacing preparations for facades, interior walls, floors, ceilings, etc., are subject to a GST rate of 28%. Components and Parts for the Toilet In accordance with HSN Code 69, sanitary ceramic fixtures such as sinks, washbasins, washbasin pedestals, bathtubs, bidets, water closet pans, flushing cisterns, urinals, and other products of a like kind are subject to a GST tax rate of 28%. The Goods and Services Tax (GST) is charged at a rate of 28% on sanitary ware and components made of iron and steel. Pipes made of ceramic, conduits made of ceramic, guttering made of ceramic, and pipe fittings made of ceramic all have a GST charge of 28%. Pipe and tube fittings (including couplings, elbows, and sleeves) manufactured from copper, aluminum, plastic, nickel, iron, or steel are subject to a Goods and Services Tax (GST) of 18%. Wallpapers Wallpaper and other wall coverings are subject to a goods and services tax (GST) in the amount of 28%. Table of Contents and Products There is a sales tax of 18% on padlocks and locks respectively (keyed, combination, or electronic). Mountings, fittings, and other similar commodities made of base metal that are. used in the assembly of furniture, doors, stairways, windows, or blinds are subject to a GST tax rate of 28%.

Your comment submitted.